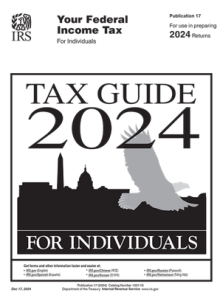

The Internal Revenue Service (IRS) has released its official Tax Guide 2024, now available for pre-order through the Government Publishing Office (GPO) Bookstore.

The Internal Revenue Service (IRS) has released its official Tax Guide 2024, now available for pre-order through the Government Publishing Office (GPO) Bookstore.

“Your Federal Income Tax for Individuals,” also known as IRS Publication 17, is a comprehensive guide published by the IRS that provides information about filing federal income tax returns for individuals.

Your Federal Income Tax for Individuals, IRS Publication 17, 2024, begins with the rules for filing a tax return. It explains who must file a return, which tax form to use when the return is due, how to e-file your return, and other general information.

It provides guidelines for filing a federal income tax return, which includes information on:

- Identifying your filing status (single, married, filing jointly, etc.)

- Determining what income is taxable

- Claiming dependents

- Calculating your tax liability

- Taking deductions and credits

It supplements the information contained in your tax form instructions. It provides additional details and explanations to help you understand the tax forms.

The GPO Online Bookstore – Easy Access to Federal Publications

HOW DO I OBTAIN THIS RESOURCE?

Sign up to receive promotional bulletin emails from the US Government Online Bookstore.

Shop Online Anytime: You can buy a vast majority of eBooks or print publications —with FREE Standard Shipping worldwide— from the U.S. Government Online Bookstore at https://bookstore.gpo.gov.

Order by Phone or Email: Call our Customer Contact Center Monday through Friday, 8 am to 4:30 pm Eastern (except US Federal holidays). From US and Canada, call toll-free 1.866.512.1800. DC or International customers call +1.202.512.1800.

Visit a Federal depository library: Search for U.S. Government publications in a nearby Federal depository library. You can find the records for most titles in GPO’s Catalog of U.S. Government Publications.

Find more than a million official Federal Government publications from all three branches at www.govinfo.gov.

About the author: Blogger Trudy Hawkins is the Senior Marketing & Promotions Specialist in GPO’s Publication & Information Sales Office supporting the U.S. Government Online Bookstore (https://bookstore.gpo.gov).

Posted by Trudy Hawkins

Posted by Trudy Hawkins