“Every single day, someone somewhere makes a gigantic mistake by giving his or her money to a fraudster,” says Bart Chilton, one of the commissioners of the Commodity Futures Trading Commission (CFTC). Chilton is the author of Ponzimonium: How Scam Artists are Ripping Off America, a shocking new book available from GPO about some of the worst perpetrators of investment fraud in recent U.S. history.

“Every single day, someone somewhere makes a gigantic mistake by giving his or her money to a fraudster,” says Bart Chilton, one of the commissioners of the Commodity Futures Trading Commission (CFTC). Chilton is the author of Ponzimonium: How Scam Artists are Ripping Off America, a shocking new book available from GPO about some of the worst perpetrators of investment fraud in recent U.S. history.

Figure 1: Ponzimonium: How Scam Artists Are Ripping Off America available from GPO.

Ponzimonium looks to the CFTC’s own recent public case files stemming from fraud investigations that began with the recent economic downturn- talk about hitting people when they’re down! Because of the this, the book is generating a lot of positive buzz in The New York Times, TheStreet, and other media outlets.

The CFTC is an independent Federal agency with the mandate to regulate commodity futures and options markets in the United States. After the financial crisis of 2008, their authority was expanded under the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act to include over-the-counter derivatives markets and hopefully prevent and uncover more of these frauds.

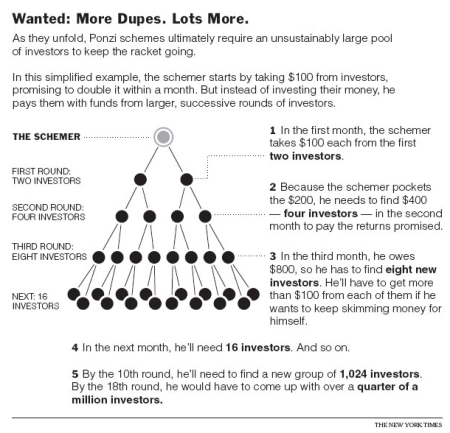

What is a Ponzi scheme, you ask?

The world really learned about Ponzi schemes in December of 2008 when, as Chilton writes in his introduction, “legendary investment guru Bernard Madoff ‘made off’ with an estimated US$50 billion in what was called the ‘Mother of all Ponzi Schemes’.” (By the way, an interesting related read is the report about the Investigation of Failure of the Securities and Exchange Commission To Uncover Bernard Madoff’s Ponzi Scheme, also available from GPO.)

Unlike pure pyramid schemes in which it is mandatory that a new investor recruit others into the deal in order to receive payments, Ponzi schemes purport to offer investors a “too good to be true” deal by simply handing over their money. However, no real investment is made by the criminal.

Instead, Ponzi schemes, named after 1920’s postage stamp speculator-fraudster Charles Ponzi, are scams in which early “investors’—often friends, colleagues, and family members—are asked to invest in a this great “no risk” deal offering unbelievable returns.

Typically, the investor makes an initial investment and then some purported “phantom profits” are paid out by the con artist (really just money from other investors), prompting that investor to assume that his or her money has increased in value—and inspiring the investor to turn over more money to invest and tell others about it. In actuality, the perpetrators pocket the money for themselves.

This splendid infographic from the New York Times explains the concept visually:

Figure 2. Ponzi scheme infographic. Image source: The New York Times 12/21/2008 Week in Review.

Made in Madoff’s Image

Ponzimonium introduces some of the lesser known, but equally despicable fraudsters that have been uncovered since 2008 by the CFTC and SEC (Securities and Exchange Commission).

The book lays out the fascinating and dramatic details behind the fraudulent schemes, their smooth-talking masterminds, and their many honest, hard-working victims, who often lose the money they’ve saved for their kids’ college funds, needed health care expenses, or their own retirement as a result of misplaced trust in these criminals.

These stories are so engrossing— at times it felt like I was taking in a marathon of America’s Most Wanted or I Almost Got Away with It episodes— I found it hard to decide which of these criminals is the most despicable. Was it Beau Diamond of Diamond Ventures who wiped out his parents’ savings along with 200 other clients who invested US$37 million? Or how about Marvin R. Cooper of Billion Coupons, who created a combination Ponzi and pyramid scheme called an affinity fraud, to t arget and recruit fellow deaf community members in the U.S. and Japan? And there’s James Ossie of CRE Capital Corporation (CRE) who bilked investors out of US$25 million, including a desperate father’s US$200,000 he invested to fund his young daughter’s cancer treatments.

arget and recruit fellow deaf community members in the U.S. and Japan? And there’s James Ossie of CRE Capital Corporation (CRE) who bilked investors out of US$25 million, including a desperate father’s US$200,000 he invested to fund his young daughter’s cancer treatments.

Figure 3. Fraudster Marvin R. Cooper and deaf client. Image source: BusinessInsider.com

The human side behind these frauds makes them all the more compelling… and contemptible.

The best way to avoid getting swindled, advises Chilton, is to “remember what your parents told you when you were little: ‘Don’t take candy from strangers’”, and my personal favorite, “Just because it is on the TV, Internet, etc. doesn’t mean it’s real!” That’s advice you can take to the bank.

Some “don’t miss” features of this book

Ponzimonium: How Scam Artists are Ripping Off America includes some very useful features for its readers that make this a valuable resource for any investor.

- Red Flags of Fraud: Includes 20 red flags to look out for when considering an investment.

- Investor Checklist: Detailed list of questions to ask before investing.

- Investors’ Bill of Rights: Common sense advice and legal rights for any investor.

- Resources: Useful contact information for victims or witnesses of a fraud.

- Glossary of Fraud Terms: Definitions of legal and financial terms within each story.

- The Loot: Color photos of the criminals’ misbegotten gains and lavish lifestyle.

- The Numbers: Calculations of the staggering amounts collected, paid, lost, or stolen, and prison sentences and restitution.

How can you get this Ponzimonium eBook?

- Get it online 24/7 at GPO’s Online Bookstore.

- Find it in a library.

About the Author: Michele Bartram is Promotions Manager for GPO’s Publication and Information Sales Division and is responsible for online and offline marketing of the US Government Online Bookstore (Bookstore.gpo.gov) and promoting Federal government content to the public. She has been researching identity theft and privacy issues for years, both on the web and in the real world, and is a big fan of more fraud protection for citizens.

[…] a Comic Lens, The Nuttall Tick Catalogue, Dr. Seuss, U.S. Army, Sprocket Man!, War Games, and Ponzimonium. You'll chuckle over the odd, quirky, ironic or inadvertently funny titles of the books […]

LikeLike

Aw, this was an incredibly good post. Taking the time and actual effort to produce a very good article… but what can I say… I procrastinate a whole lot and don’t seem to get nearly anything done.

LikeLike

Τhis info іs wоrth everyone’s attention. Where ϲan I find out more?

LikeLike

Keep your investment plan simple if you are just starting out.Really enjoyed this blog article.Thanks.Really Great.Thanks and I can be absolutely sure several value the information .

LikeLike

Great information. Lucky me I ran across your

blog by chance (stumbleupon). I’ve book marked it for later!

LikeLike

[…] November 2011, Government Book Talk reviewed the recently released book in Part I of this 2-part Ponzimonium blog […]

LikeLike

I do think any time you can easily help anyone with this it is usually positive to do . Thanks and I can be absolutely sure several value the information .

LikeLike

Keep your investment plan simple if you are just starting out.

It can be tempting to diversify right away and try everything you have read about or learned. But, if you are new at investing it is best to find one thing that works and stick with that. It will save you money in the long run.

LikeLike

It’s an absolute shame when you think about people who are the age of my parents who have lost everything to Madoff and others. I know that everyone is not in this position, but if you have senior adult parents try to monitor what they do. I am fortunate that my dad trusts me to look into his accounts. We need to protect our friends and relatives as much as possible.

LikeLike

Hear, hear!

LikeLike

Do you think this book still available on the market and where i can get its best cheaply price?

LikeLike

Jay- It is still available from GPO, and was just added to our 50% Off Overstock sale! Check our online bookstore tomorrow under ISBN 9780160890796 to find it priced for $8.50 INCLUDING FREE SHIPPING anywhere in the world…

LikeLike

I must say that i have been very impressed with the quality and content material on this blog site and I will absolutely be back for some more studying and I would say it is also worth a bookmark!

LikeLike

great tips, really opened my eyes

LikeLike

Really enjoyed this blog article.Thanks Again. Really Great.

LikeLike

Funny how the biggest scammers on the planet seem to have the ability to not get caught! – Most even avoid prison!

LikeLike

Here’s what I have to say to all the thieves and scammers! LOSERS. Get a real job. May every cent you steal be stones upon your heads. May every life you ruin and cause harm to come back upon you 100 fold. May every credit card, name, address and birth date you steal and use for your own benefit, when it’s someone else’s life, may you suffer one year for every cent you steal. Not until you stop stealing will these curses stop. This applies to all who callously steal from others (especially elderly and disabled) to further their own lifestyles. Those who steal from the most vulnerable will receive the worst karma imaginable. Boy, is it worth it? A few days of fun, for a lifetime of curses. Boy, that’s smart.

LikeLike

Thanks for the English perspective – good to hear from a club player from another part of the world….

[…]Ponzimonium: How Scam Artists Are Ripping Off America « Government Book Talk[…]…

LikeLike

It’s wise to pack up the investment activity, just after getting back the return of the very first round of scheme.

It’s also better to ban such scheme activity full of the risk of being cheated.

However, for creating mass awareness, such type of book’s role is beyond question, no doubt.

Ripon #

LikeLike

I like the helpful info you supply on your articles. I will bookmark your weblog and check again right here frequently. I am quite certain I’ll be informed lots of new stuff proper here! Good luck for the following!

LikeLike

The people most vulnerable to such scams are opportunistic individuals. Sometimes, it does not pay to be opportunistic.

LikeLike

Modern globe is filled with a huge array of many varieties of people young and old. It applied to be that you could surprisingly immediately decipher the big difference around an straightforward male and a liar. In my expertise, it is not so straight forward any more. I have looked at some extremely tragic stuff take put in my time most of which have to do with dishonest individuals ripping off straightforward people.

LikeLike

Dear Govbooktalk,

Thanks for the info, Nevertheless a wide selection of MLMs (multi-degree advertising corporations) are reputable, some are outright scams and rip-offs. If you happen to be trying to get an Multi-level marketing chance to bring in an money, you can understand the ripoffs right from the start out if you know how. Becoming able to figure out and keep away from the frauds will not only conserve you moolah, but also a great deal of heartaches on your dwelling small business journey.

BTW great blogpost

False

LikeLike

The stock market is no longer a place to invest, rather a place to gamble. You aren’t investing in the future of a company, you are simply trying to make a quick 4% and then sell. There is so much volatility in this company that putting your investments into it is just too risky. Buy bonds instead and wait patiently.

LikeLike

Having had family members who have battled cancer, I know how desperate people will do nearly anything to get well.

The people who exploit sufferers deserve all the law can throw at them and then some. No low security, country club style lockup, put them in with the murderers and rapists and let the rest of their type know how they fared on the inside.

LikeLike

Whoever came up with that title, KUDOS!!! You made a book, based on such an evil trend, more enjoyable by using the portmanteau Ponzi and Pandemonium.

I hope you have a chapter called “Madoff with millions.”

Another great book for the enlightened masses. I’ll recommend it highly for my Library to purchase.

Sincerely,

Jeff

LikeLike

Money In The Future : Much or Many ?

It’ll be lose. The mankind are angry to the scam and fraud people and create the communities who loved and trust communities. No markets, no offices and no trades. The money will be changed by smile, shake hands, barters and interchangeable among them. The mankind are bow to The Queen who is just only saver its!

LikeLike